Wednesday, 18 Dec 2024

Time : 8:15 AM IST

Report:

Understanding Yesterday’s Market:

- Nifty Performance:

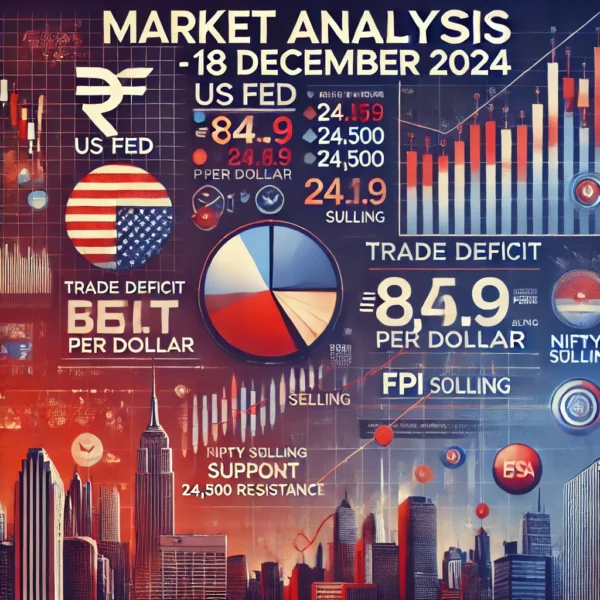

- Nifty fell by 332 points, closing at 24,336.

- Market Trend:

- The fall was a one-way decline, with the market starting to drop right from the opening bell.

- Reasons for the Fall:

- November EXIM Data: The trade deficit hit an all-time high.

- New FPI Regulations: The new norms for FPIs likely triggered significant selling, with FIIs offloading equities worth ₹6,410 crores in the cash market.

- Fed Policy Outcome:

- The Fed policy outcome is expected today and will impact the markets tomorrow.

- Markets are anticipating a 25 bps rate cut. However, any uncertainty regarding the cut could negatively affect US markets, which, in turn, would impact Indian markets.

- Rupee Decline:

- The rupee continues to weaken against the US dollar, currently at ₹84.9 per dollar, which is a negative signal for broader markets.

- Technical Levels:

- The Nifty closed below the crucial support level of 24,500, signaling short-term negativity.

- Fed Rate Cut Impact:

- If the US Fed cuts rates as expected, it would be a positive for markets, but the impact might not be significant.

Today’s Cues:

- Global Markets:

- US Markets: The Dow Jones fell by 0.6% ahead of the Fed meeting.

- European Markets: Closed lower.

- Asian Markets: Trading mixed.

- GIFT Nifty:

- GIFT Nifty indicates a 50-point negative start for Indian markets.

- Key Levels:

- Support:

- 24,150, which is the recent low.

- 24,315, the 20 DMA and a crucial level for markets to take support

- Resistance:

- 24,500, as per OI data, where call writers show confidence.

- Support: