Monday, 6th Jan 2025

Time : 8:00 AM IST

insights :

- Let’s understand Friday’s market:

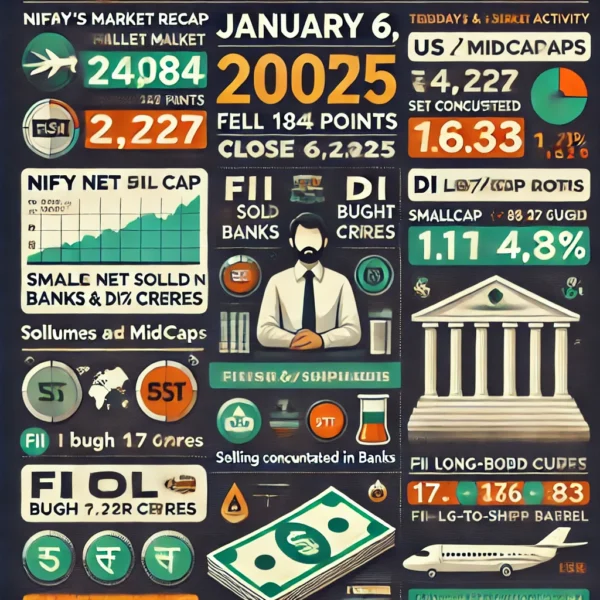

- Nifty fell by 184 points, closing at 24,004, a decline of 0.76%.

- Despite Nifty’s fall, the Smallcap and Midcap indices were relatively stable, down only 0.24% and 0.3%, respectively.

- The selling pressure was concentrated in Banks and IT stocks, which dragged Nifty lower.

- Volumes:

- Trading volumes showed improvement compared to recent times.

- FII and DII Activity:

- FIIs were net sellers, offloading ₹4,227 crores in the cash market.

- DIIs stepped in as net buyers, purchasing ₹820 crores.

- FIIs are increasing their short positions in index futures. Their current long-to-short ratio stands at 17% longs and 83% shorts.

- Cues for Today:

- US Markets: Closed in green on Friday.

- Asian Markets: Trading mixed; the Nikkei is down 0.7%, while the Taiwan and Kospi indices are up by over 1% each.

- Global Indicators:

- The Dollar Index is at 108.88.

- US 10-year bond yields are at 4.63%.

- Both the Dollar Index and bond yields need to cool off or consolidate before consistent FII inflows can be expected.

- Brent crude oil is trading at $76.56 per barrel.

- GIFT Nifty: Indicating a mild positive start for the day.

- Key Event:

- HDFC Bank’s Q3 update is expected today. Early indications suggest a weakish performance.

- Market Range:

- Nifty is likely to trade within the range of 23,900 to 24,300.