Tuesday, 14th January 2025

Time : 8:15 AM IST

insights :

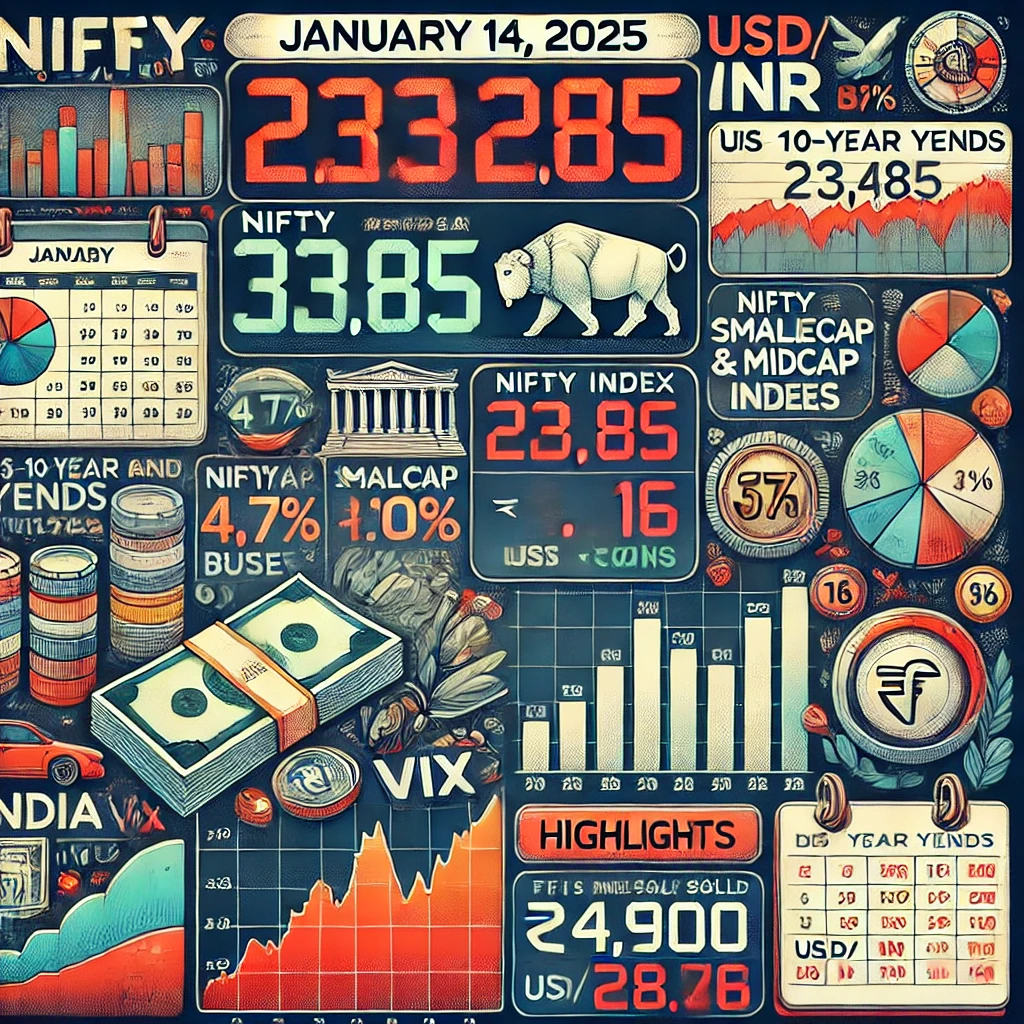

1. Let’s understand yesterday’s market: Nifty fell by 345 points and closed at 23,085, marking a “Monday Mayhem.”

2. All indices closed in red. Nifty Smallcap and Midcap indices fell more than 4%. From Friday’s high, these two indices nearly fell about 7%.

3. India VIX rose by 7%, trading nearly at 16.

4. The fall was due to concerns over rising US bond yields and Dollar Index. US 10-year bond yields are at 4.7%, and the Dollar Index is at 110, causing significant concerns for emerging markets. This is triggering FIIs to pull money out of Indian markets, leading to further retail sell-offs.

5. FIIs net sold ₹4,900 crores, while DIIs net bought ₹8,000 crores. FIIs’ net shorts in index futures are at 85% vs. 84% earlier.

6. USD/INR touched ₹86.7, up nearly 4.7% from January 13, 2024, till yesterday. Dollar appreciation alone is contributing 4.7%. This makes FIIs less likely to convert dollars to rupees and invest in Indian markets, where Nifty was up just 4.4% in the same period.

7. US markets ended mixed yesterday. Nasdaq closed slightly in red.

8. Asian markets are trading in red after a mixed session in US markets.

9. GIFT NIFTY is indicating a 130-point higher opening for Indian markets. The big question is whether the gap up will sustain or not?

10. Nifty broke November’s monthly low and closed below 23,260. Any bounce back might occur, but it may not be a real recovery unless the market crosses any important levels on the upside.

11. Nifty support, if it falls further, could be 22,700, while resistance could be around 23,260.