Thursday, 30th January 2025

Time : 8:15 AM IST

Insights:

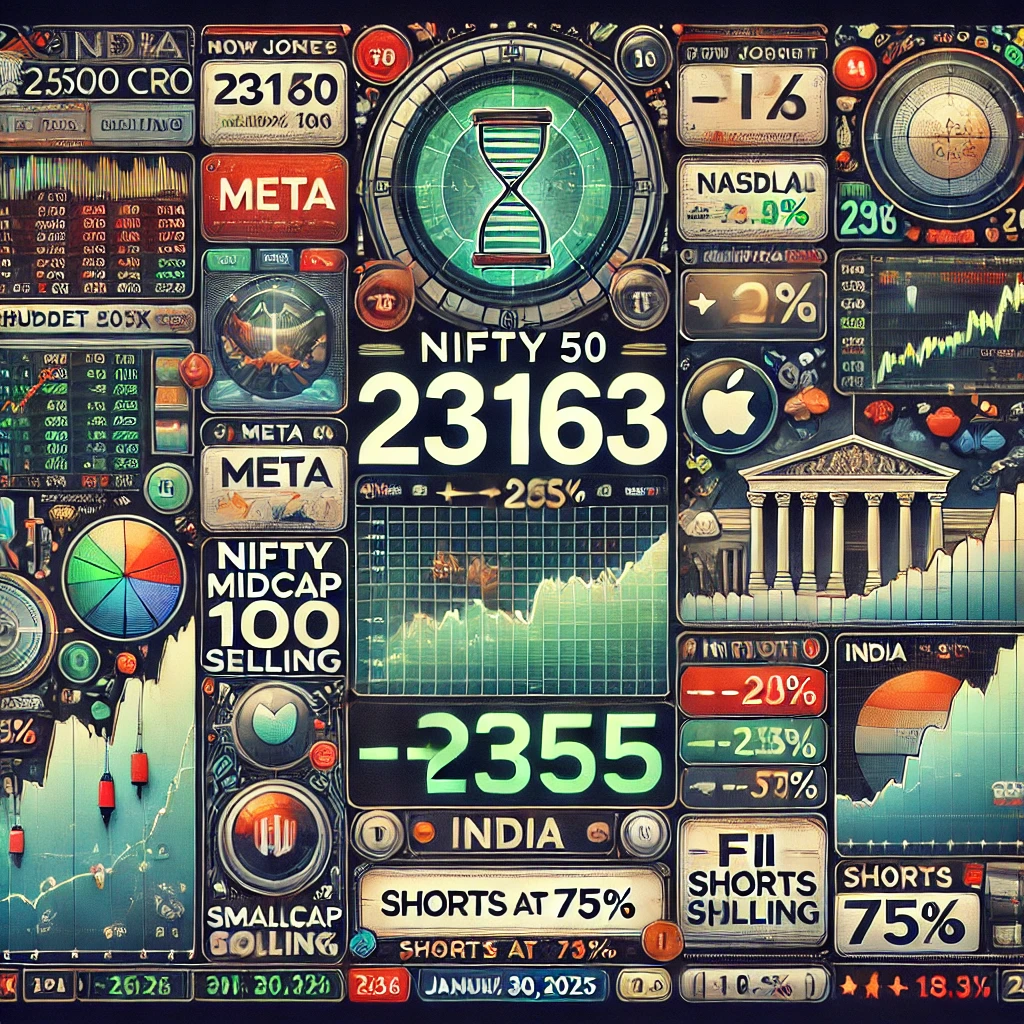

1. Yesterday, Nifty gained 205 points and closed at 23,163.

2. It was a broad-based rally:

Nifty Midcap100 gained over 2%.

Nifty Smallcap100 gained over 3%.

3. US Markets ended marginally lower:

Dow Jones was down by 0.3%.

Nasdaq was down by 0.5%.

4. US Fed did not cut rates (as expected), but the tone was more hawkish.

5. Earnings Results:

Meta: Up 2%.

Microsoft: Down 5%.

Tesla: Up 4% post results.

6. Asian markets:

Many are closed due to Chinese New Year.

Japanese index is trading marginally in green.

7. Dow Futures are trading higher.

8. GIFT Nifty is almost flat.

9. FII’s activity:

Sold for more than Rs 2,500 crores in the cash market.

Unwound 6.9k longs and covered 19.3k shorts yesterday.

FII’s shorts now stand at 75%.

10. All eyes on the Budget:

Usually, ahead of a make-or-break budget, traders keep positions light.

However, this time, calls are priced higher than puts, indicating expectations of a positive budget.

11. Today is Nifty JAN Series Expiry.

12. India VIX is trading around 18.6 and is expected to move higher over the next two days.

13. Market movement expectation:

Usually, there is low activity ahead of the Budget.

Expect volatile but range-bound movement for the next two days.

14. Nifty levels: Support: 23,150.

Resistance: 23,400.