Monday, 02 December

Time : 8:15 AM IST

Insights :

Understanding Friday’s Market:

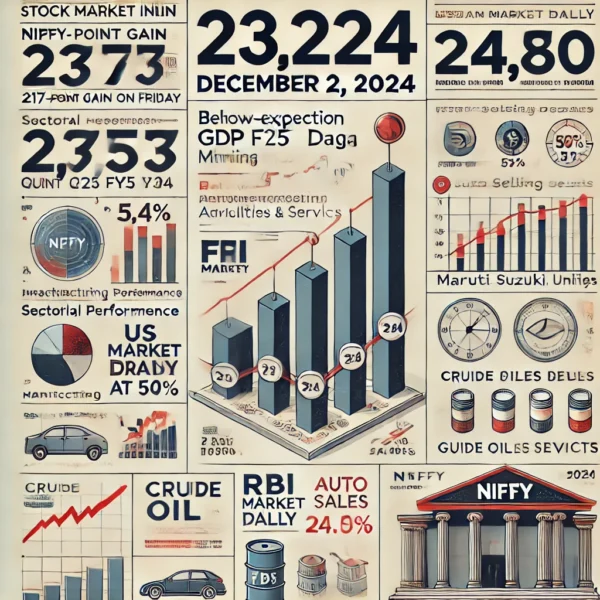

- Nifty gained 217 points, closing at 24,131 on Friday. After market hours, Q2 FY25 GDP data was released, which came in below expectations. While expectations ranged between 6.5% and 6.8%, the actual figure was 5.4%.

- This marks the lowest GDP growth in 21 months. Key contributors to the slowdown were the manufacturing sector, electricity, gas, water supply, and other utilities, along with mining. On the other hand, agriculture, services, construction, and consumption sectors showed strength in GDP’s industrial components.

- The RBI MPC meeting is scheduled from December 4-6. Before the GDP numbers were released, markets did not anticipate a rate cut. However, the lower GDP growth has raised expectations of a possible rate cut to boost the economy. At the same time, inflation remains at 6.2% (October), which is above the RBI’s comfort level of 6%. This combination of high inflation and low GDP growth creates uncertainty about the RBI’s decision.

- FIIs were net sellers on Friday, offloading ₹4,383 crores.

Today’s Cues:

- US stock markets rallied on Friday, marking November as the month with the biggest gains in 2024.

- US bond yields declined, with 10-year Treasury yields standing at 4.16%.

- Asian markets are trading in green following the rally in US markets, with investors also awaiting key economic data from China and Japan.

- China’s November Manufacturing PMI came in at 50.3, the highest level since April.

- Crude oil prices dropped 3% last week, adding to optimism for inflation-sensitive economies.

- GIFT Nifty signals a positive start for Indian markets.

- November auto sales data: Maruti Suzuki reported growth, while Hyundai India posted a decline.

- Nifty Technical Levels:

- Support: 23,750 remains a crucial level.

- Resistance: Nifty may face resistance at 24,350. If this level is breached, the index could move towards 24,800, which will act as the next major resistance.