Tuesday , 03 december 2024

Time : 8:15 am IST

insights :

Understanding Yesterday’s Market:

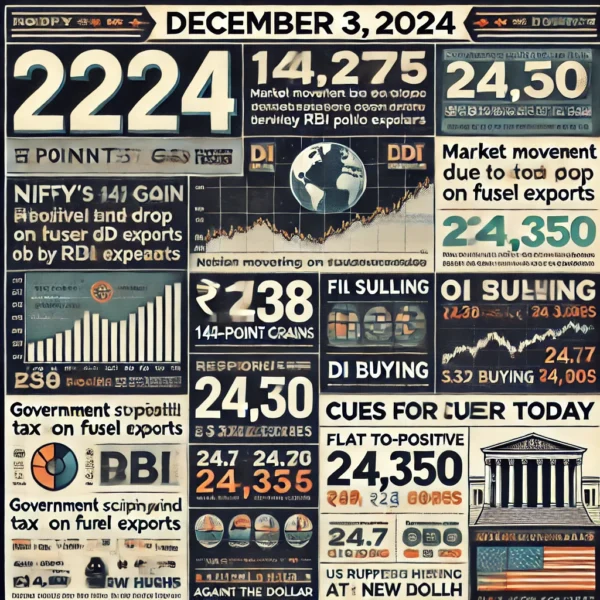

- Nifty Performance: Nifty gained 144 points, closing at 24,276.

- Market Movement: After opening flat, Nifty fell nearly 150 points but later rallied 300 points towards 24,300, closing at 24,276. The initial drop was due to lower GDP data, while the recovery was driven by growing expectations from the upcoming RBI Monetary Policy meeting on December 6.

- Expectations are building for a CRR (Cash Reserve Ratio) cut this time, with the possibility of a rate cut in February.

- A rate cut could impact bank margins in the near term, but a CRR cut would be beneficial for banks immediately.

- FII/DII Activity:

- FIIs were net sellers, offloading ₹238 crores.

- DIIs were net buyers, purchasing ₹3,588 crores.

- FIIs still hold significant short positions.

- Government Policy Update: The government scrapped the windfall tax on petrol, diesel exports, and ATF, providing relief for companies like Reliance and ONGC.

- Currency Update: The rupee hit a record low of 84.7 against the dollar in yesterday’s trading session.

Today’s Cues:

- US Markets:

- Dow Jones finished lower.

- S&P 500 and Nasdaq reached new record highs, driven by technology stocks hitting all-time highs.

- European Markets: Closed in the green.

- Asian Markets: Trading higher, with Japan’s Nikkei up by 1.6% and South Korea’s KOSPI up by 1.5%.

- GIFT Nifty: Indicates a flat-to-positive opening for Indian markets.

- Nifty Technical Levels:

- Support: 24,000 is a key level. If it breaks, 23,750 will act as the next crucial support.

- Resistance: Nifty might face resistance around 24,350.

- OI Data: Significant volumes were added to the 24,800 CE (Call Option) and 24,000 PE (Put Option) for this expiry, reflecting crucial market levels.