Monday, 23 December 2024

Time : 8 am IST

insights :

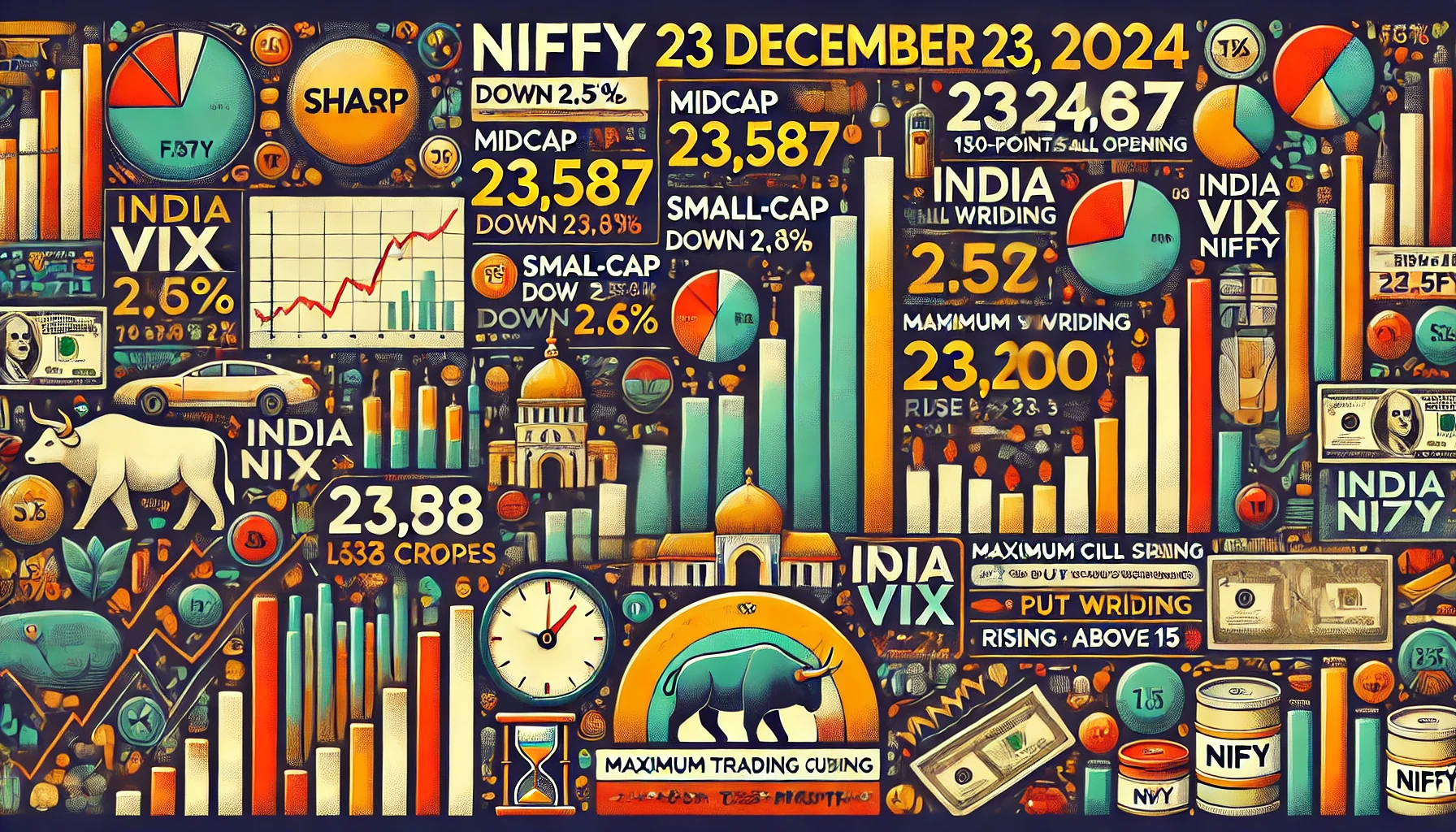

1. Let’s understand Friday’s market: Nifty was down by 364 points, closing at 23,587.

2. There was significant selling pressure around 10:30 AM, leading to a one-way fall. Until 10:30, the market experienced high volatility, with Nifty forming a 50-point red candle, then a 130-point green candle, followed by a 190-point red candle, all within 1 hour timeframe.

3. Nifty fell by 1.5%, while the midcap and small-cap indices were down by 2.5% and 2.8%, respectively.

4. The IT Index declined by 2.6%, despite Accenture’s results beating expectations.

5. FIIs sold shares worth ₹3,598 crores, while DIIs bought shares worth ₹1,374 crores. FIIs added 6.7k long positions and 29.7k short positions, with their long-to-short ratio at 31:69. Their net shorts have doubled compared to last week.

6. The rising dollar index and US bond yields are now a concern for emerging markets, as they may trigger FIIs to pull money out of these markets.

Today’s Cues:

7. US markets closed higher on Friday, with the Dow up by 1%.

8. Asian markets are trading higher.

9. The dollar index is trading at 107.8, cooling off from its recent high of 108.5. However, US 10-year bond yields remain elevated, trading at 4.52%.

10. Crude oil prices are steady, trading just above $73.

11. India VIX rose by 3.8% on Friday and is trading slightly above 15.

12. GIFT Nifty is indicating a positive start, with Nifty expected to open about 150 points higher.

Key Technical Levels:

13. Nifty broke its 200-day EMA (23,700) on a closing basis, indicating a significant bearish sentiment.

14. According to OI data, maximum call writing for the monthly expiry is seen at 24,000, while maximum put writing is at 23,200. This suggests the market may trade within the range of 23,200 to 24,000 for the month.